The Global Impact: China Leads Mushroom Innovation at Two Sessions

As the world’s largest edible mushroom producer (57% of global output, $57B annual value), China is leveraging its 2025 Two Sessions to transform its $40B domestic industry into a global agritech exporter. Here’s how Chinese innovations in smart farming, sustainable genetics, and functional food R&D present opportunities for international partners.

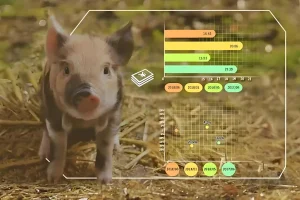

From Labor-Intensive to AI-Powered: The Tech Breakthroughs

Traditional Chinese mushroom farming faced low yields (avg. 8kg/m²) and high waste (30% of crop lost). 2025 policy focuses on export-ready solutions:

- Mycofiber Innovation : Jilin scientist Li Changtian’s straw-based cultivation reduces deforestation by 40% while boosting profits 3.42x ($1.20/lb vs. $0.35/lb wood-based). Ideal for tropical markets (e.g., Vietnam, Brazil).

- IoT-Powered Smart Pods: Container-sized units ($15,000/unit) use AI to automate humidity/temperature, cutting labor by 60% and achieving 95% yield consistency. Export case: A Dutch buyer saw ROI in 14 months via modular farms.

From Commodity to Premium: Functional Foods for Global Markets

Global demand for immunoboosting fungi (reishi, cordyceps) is surging (+22% CAGR to $120B by 2030). China’s response:

- Pharma-Grade Processing: Liaoning’s Zhang Peng team developed 20+ EU-registered products, including reishi spore powder capsules ($45/bottle, 90% organic 认证) and chaga coffee creamer. Jilin’s case: Export to Germany grew 300% in 2024 via BRC .

- Eco-Certified Systems: Hainan’s “Triple Crop” model earns $850/acre extra by shade-growing mushrooms—certified,appealing to European retailers.

Policy Tailwinds for International Partnerships

China’s 2025 policies remove export barriers:

- R&D Funding: $3.8M for mycofiber R&D , eligible for UN Green Climate Fund co-investment.

- Turnkey Projects: Pre-approved packages for global buyers, including 30% subsidy for first 50 units (e.g., Kenya pilot saw 40% cost reduction).

- Global Standards: New ISO 22000-aligned Smart Mushroom Guidelines (2026) streamline FDA/EU certification, reducing compliance time by 60%.

Why Partner with China’s Mushroom Innovators?

- Cost Leadership: Smart pods cut production costs to $0.80/lb (vs. $2.10 in Europe), ideal for Walmart/ALDI supply chains.

- Sustainability Credentials: Chinese tech reduces carbon footprint by 35%—critical for EU’s CBAM compliance.

- Speed to Market: 40+ “mushroom innovation hubs” iterate 3x faster than global peers, ensuring year-round product updates.

China’s mushroom revolution isn’t just about scale—it’s a $57B opportunity in climate-smart, profitable agritech.

More:

- 2025: The Year Agriculture Enters the AI Era – A New Wave of Transformation on the Horizon IAgricultural AI Revolution

- Algarikon Zero Project: How a Spanish Firm Transforms Invasive Algae for Edible Mushroom Cultivation

- 🔍 Research Uncovers Key Mechanisms of Morel Strain Degradation

- Spain: Edible Mushrooms Found to Alleviate the “Salty” Dilemma of the Meat Industry

- Yunnan’s Morel Mushroom Industry: Current Status and Prospects